Class 12 CBSE Applied Maths Perpetuity, Sinking Funds, Bonds & EMI Exercise 12.3

Class 12 CBSE Applied Maths aims to develop an understanding of basic

mathematical and statistical tools and their

applications in the field of commerce (business/ finance/economics) and social

sciences. Topics covered in Class 12th Applied Maths includes : Numbers, Quantification and

Numerical Applications, Algebra, Calculus, Probability Distributions , Inferential Statistics, Index

Numbers and Time-based data , Financial Mathematics , Linear Programming.

Please Select

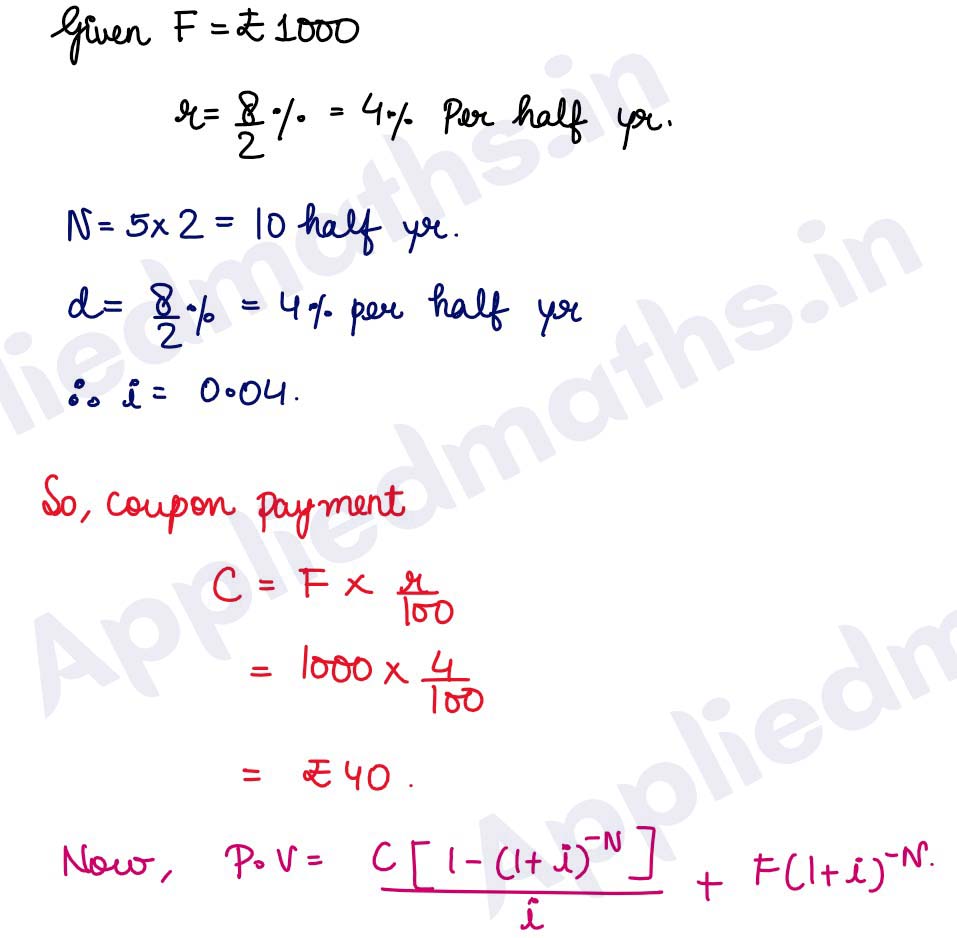

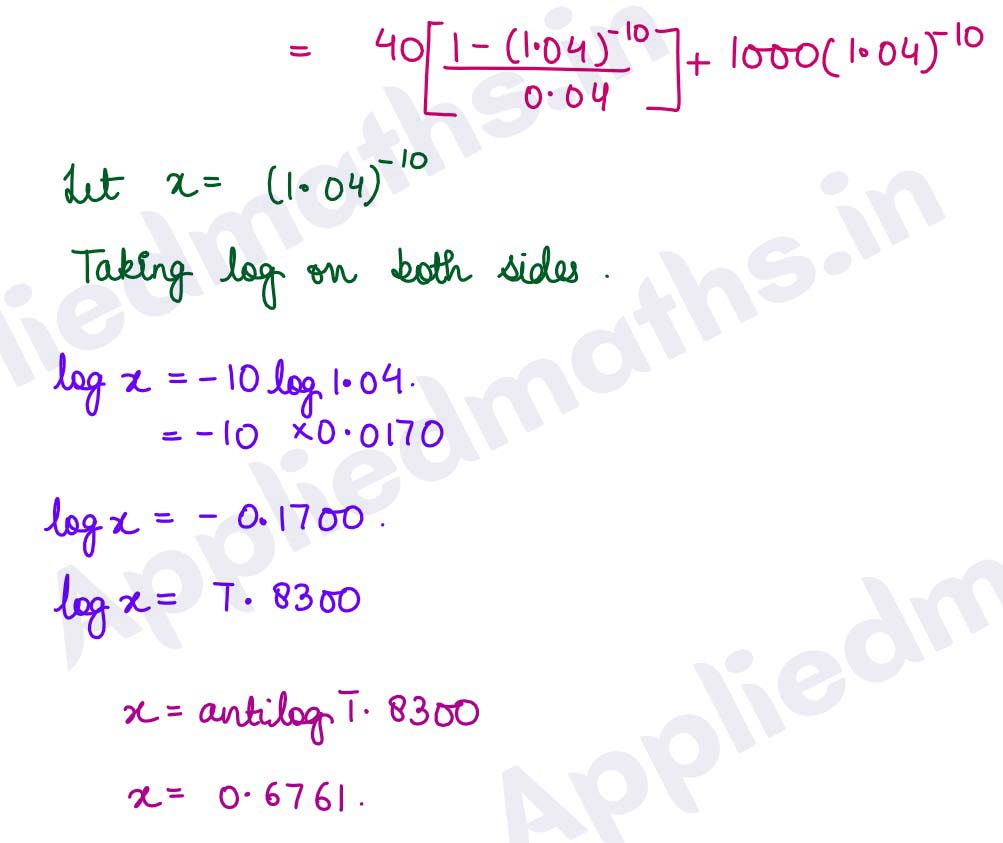

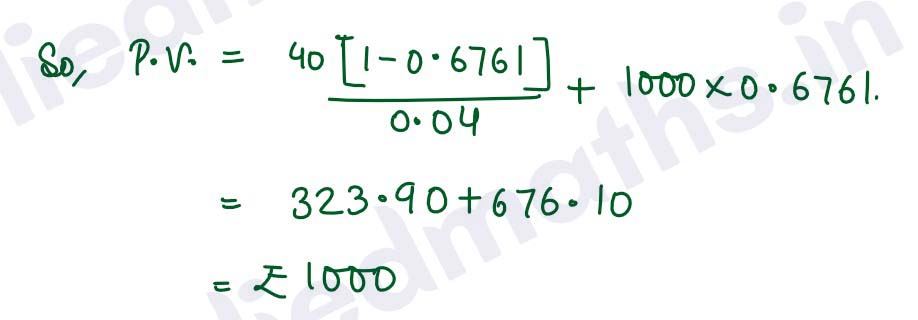

Q1. Abond has a coupon rate of 8% per annum with interest paid semi-annually. The bond’s face value is Rs 1000 and it matures in 5 years. If the bond is priced to yield 8% P.a., what is the bond’s current price?

Solution :

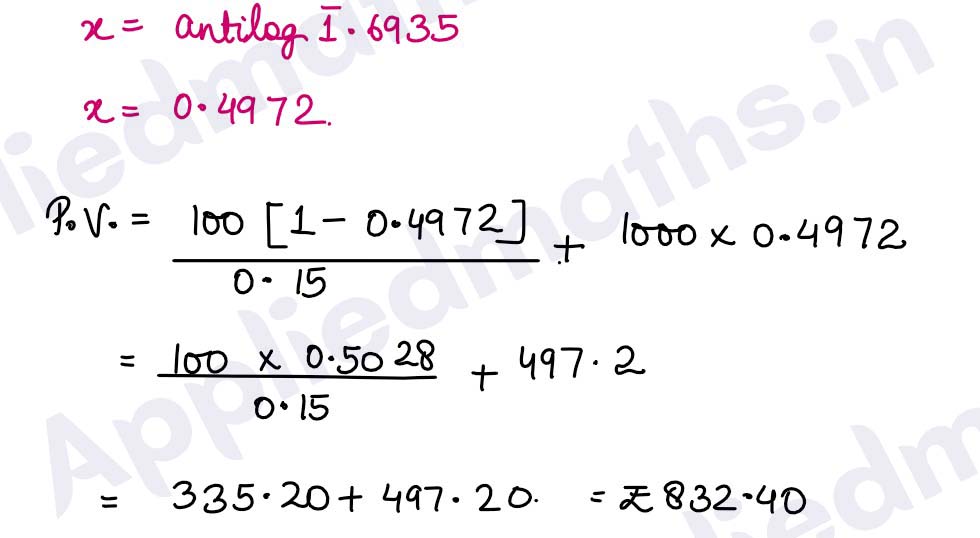

Q2. A Rs 1000 face value bond bearing a coupon rate of 10% p.a. will mature in 5 years. If the discount rate is 15% p.a., find the present value of the bond.

Solution :

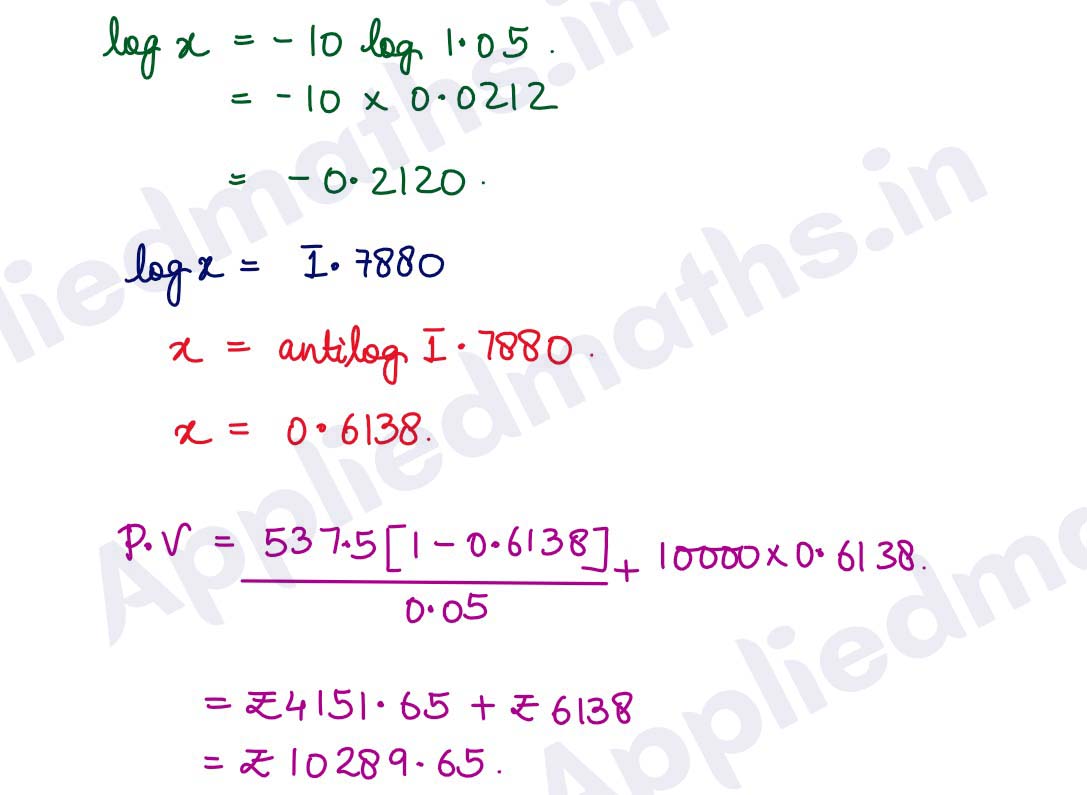

Q3. A bond has a face value of Rs 10000, a coupon rate of 10.75% p.a. paid semi-annually and matures in 5 years. If the yield to maturity is 10%, find the current price of the bond.

Solution :

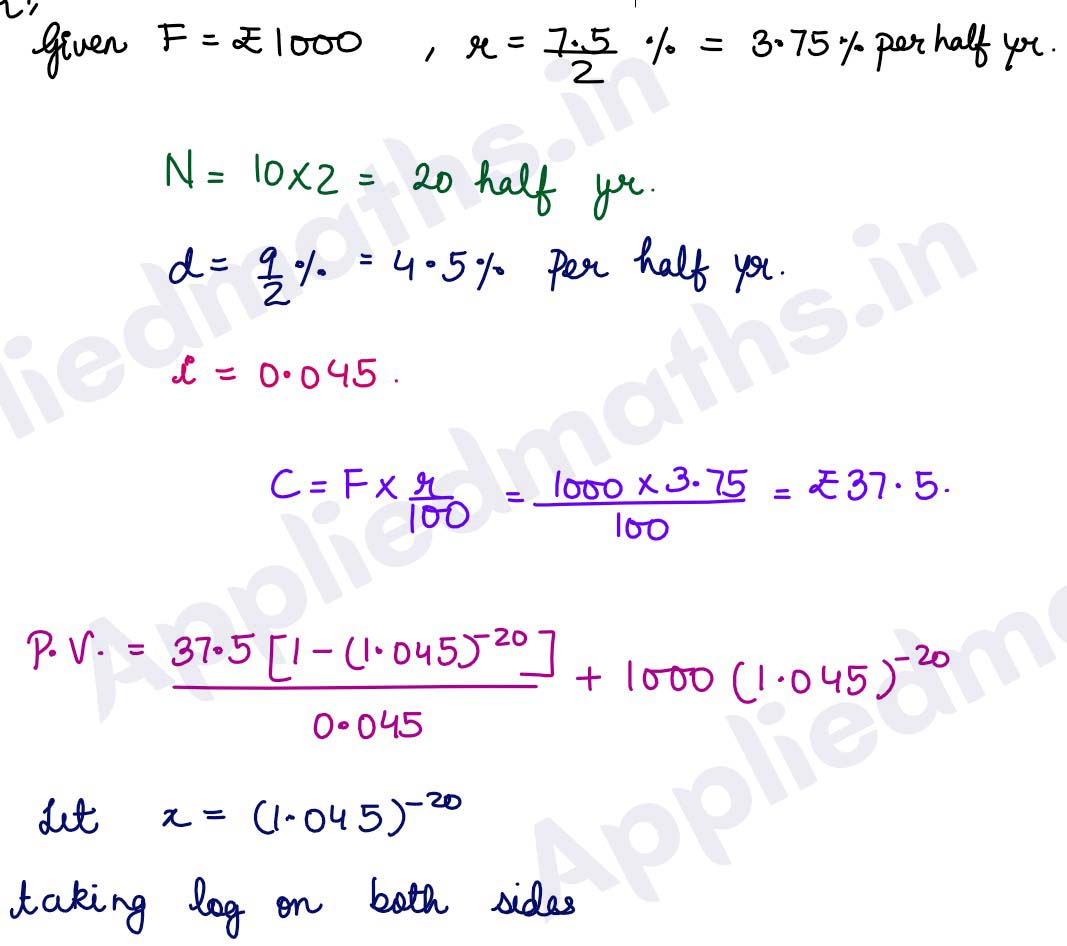

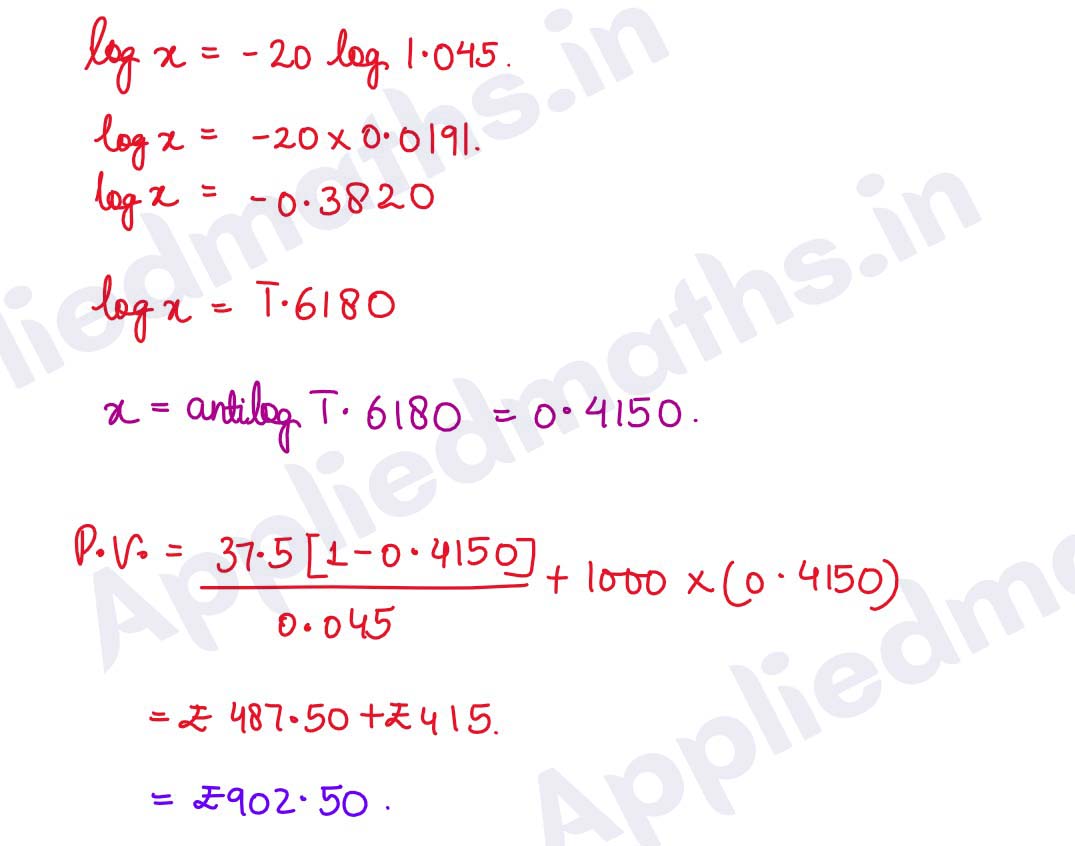

Q4. Find the current price of a bond of face value Rs 1000 coupon rate 7.5% p.a. paid semi-annually matures in 10 years and yield to maturity is 9% p.a.

Solution :

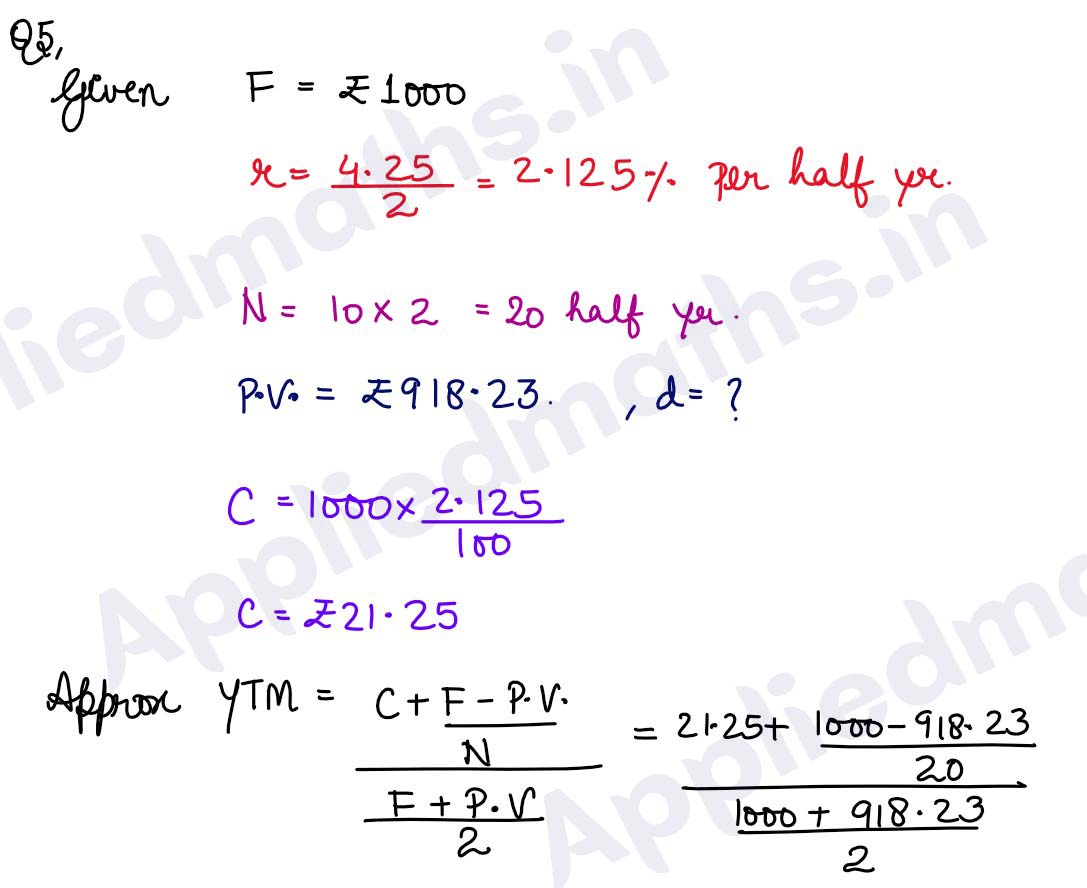

Q5. Face value of a bond is Rs 1000, coupon rate 4.25% p.a. paid semi-annually and matures in 10 years. If present value of bond is Rs 918.23, what is yield to maturity?

Solution :

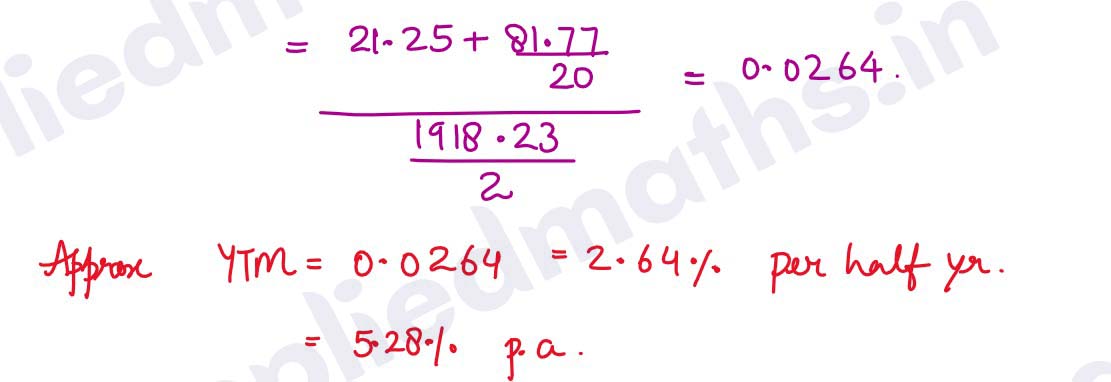

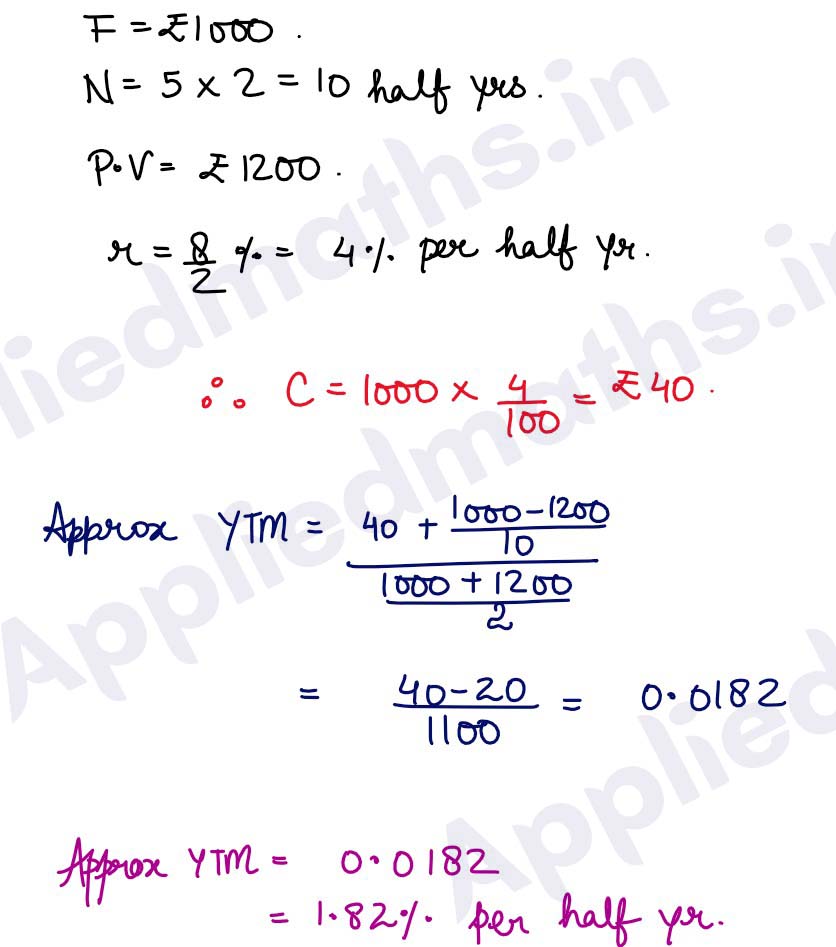

Q6. A bond has a face value of Rs 1000 matures in 5 years and present value is Rs 1200. If coupon rate is 8% p.a. paid semi-annually, find the yield to maturity.

Solution :

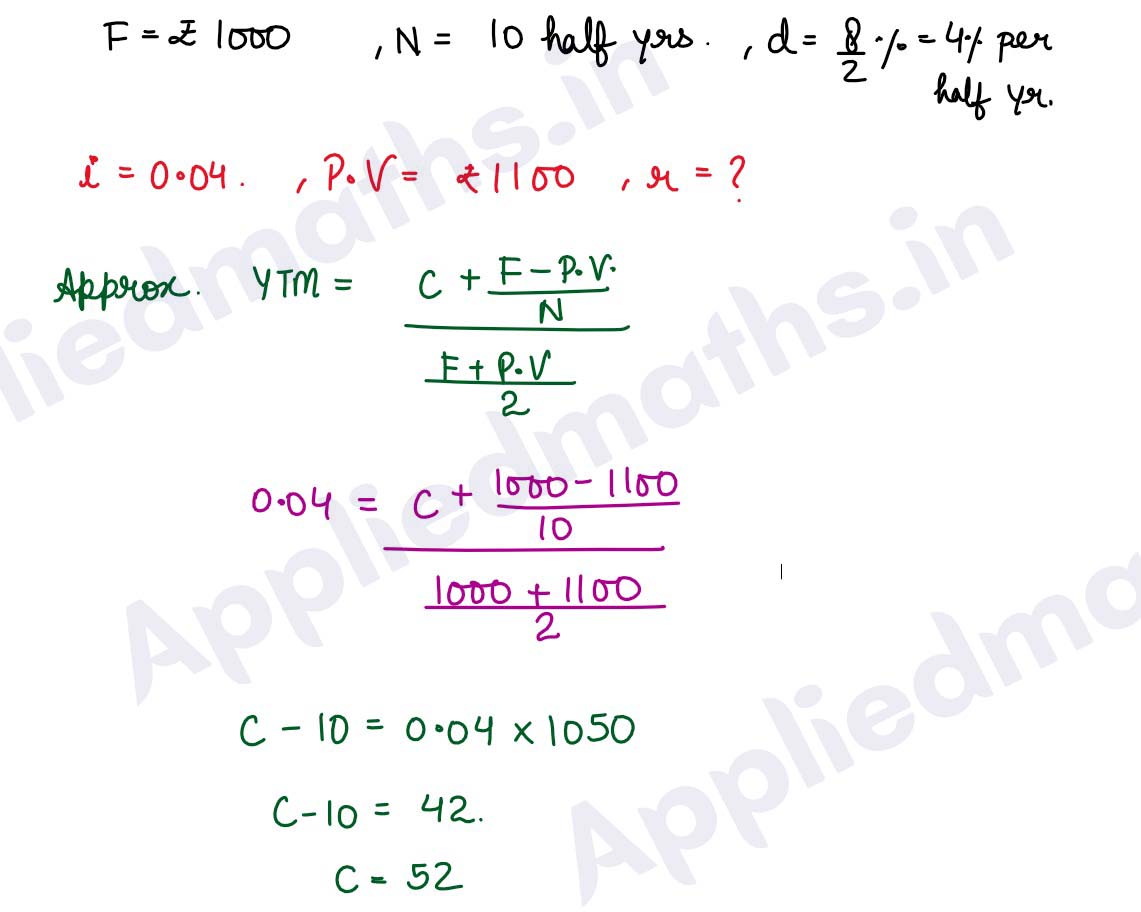

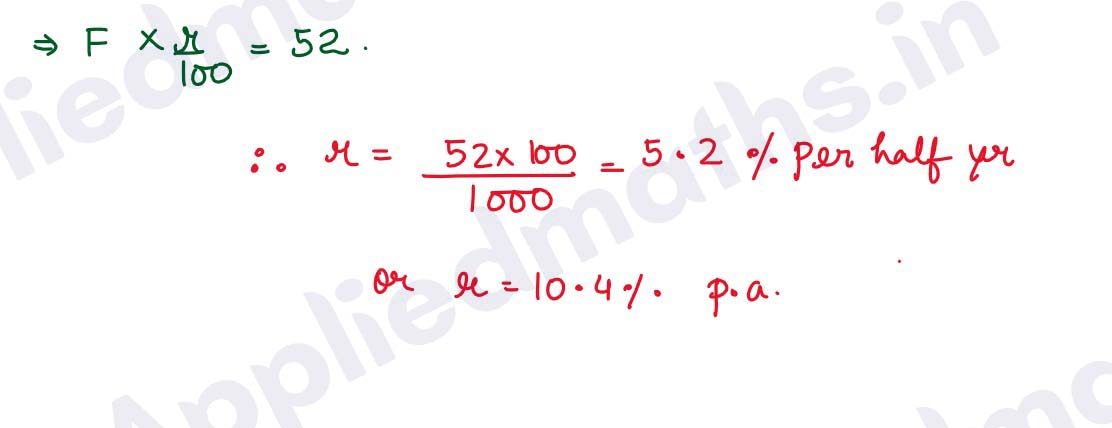

Q7. A bond of face value Rs 1000 matures in 5 years. Interest is paid semi-annually and bond is priced to yield 8% p.a. If the present value of bond is Rs 1100, find the annual coupon rate.

Solution :