Class 12 CBSE Applied Maths Stocks, Shares & Debentures Exercise 13.2

Class 12 CBSE Applied Maths aims to develop an understanding of basic

mathematical and statistical tools and their

applications in the field of commerce (business/ finance/economics) and social

sciences. Topics covered in Class 12th Applied Maths includes : Numbers, Quantification and

Numerical Applications, Algebra, Calculus, Probability Distributions , Inferential Statistics, Index

Numbers and Time-based data , Financial Mathematics , Linear Programming.

Please Select

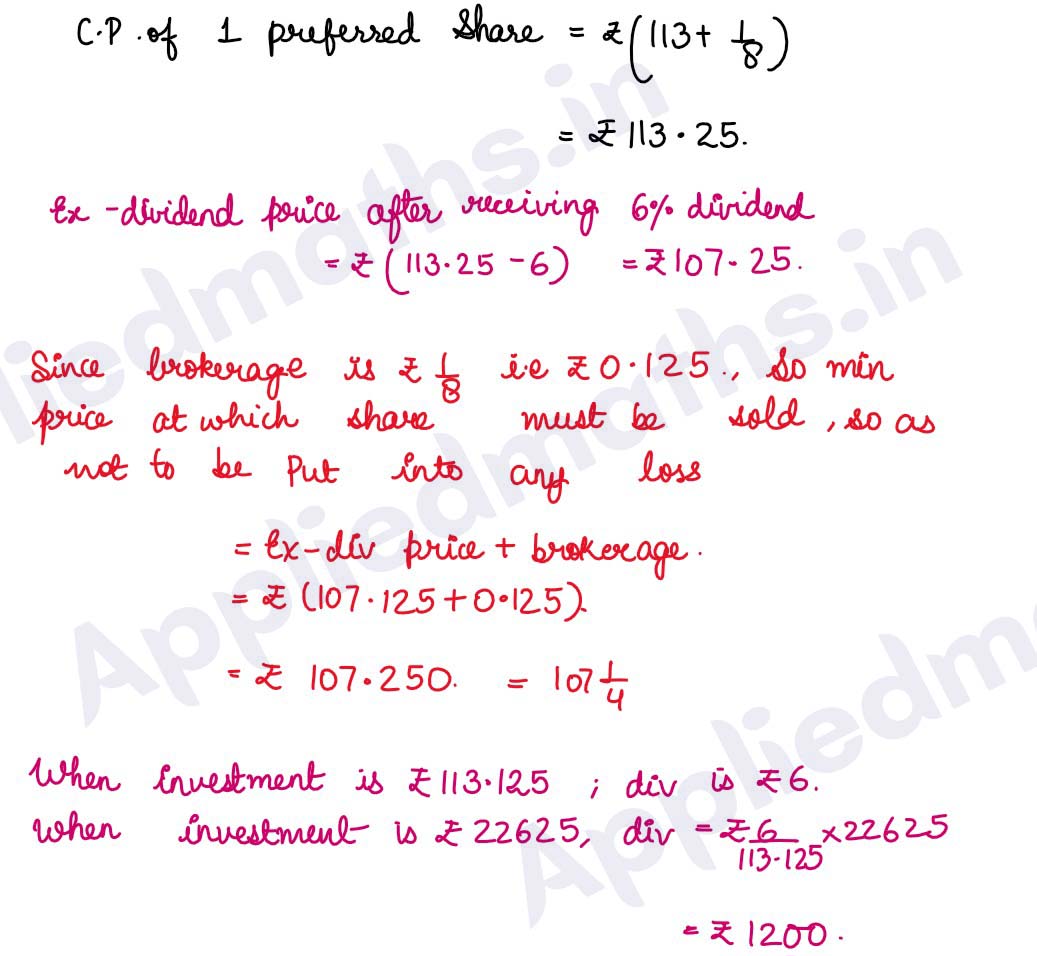

Q1. How much 3(1/2) % stock at 112(1/3) should be sold to realize Rs 5600, brokerage being 1/3 ?

Solution :

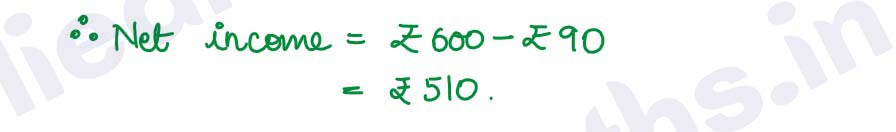

Q2. A man buys Rs 10000 stock at 85 and sells at 92. What is his profit, brokerage being 1/2 and income tax being 15 paise per rupee?

Solution :

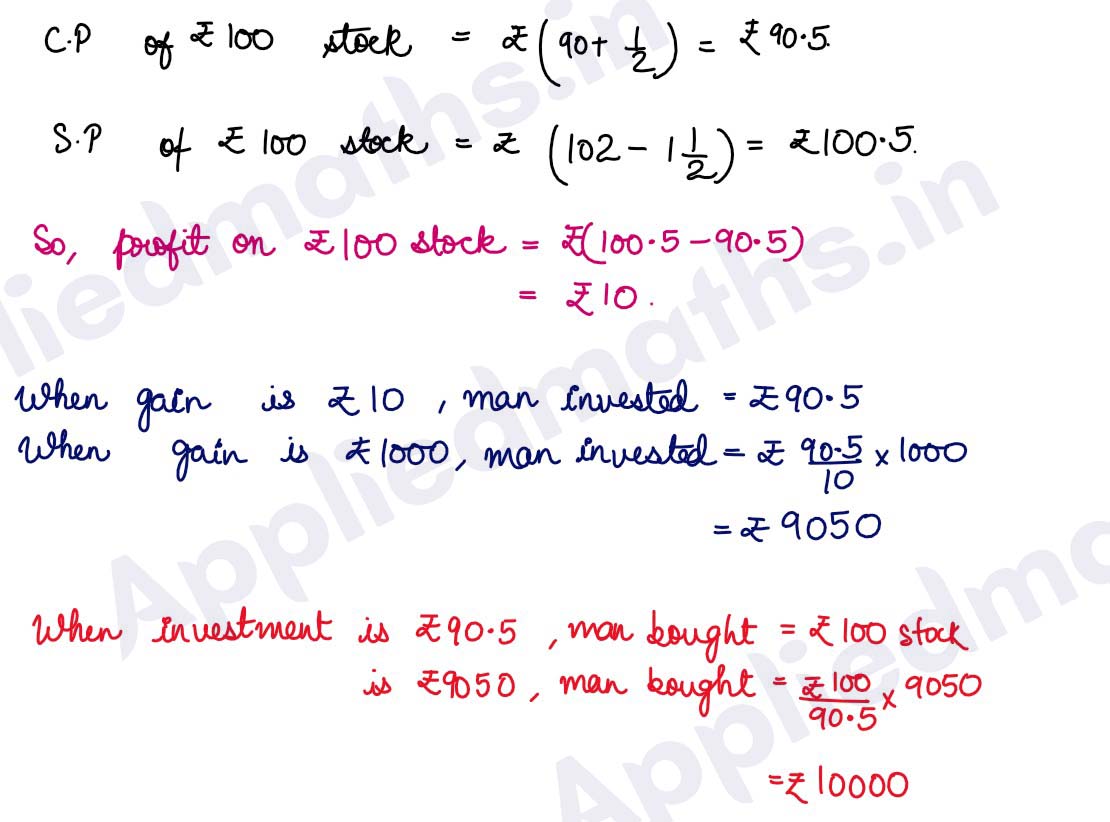

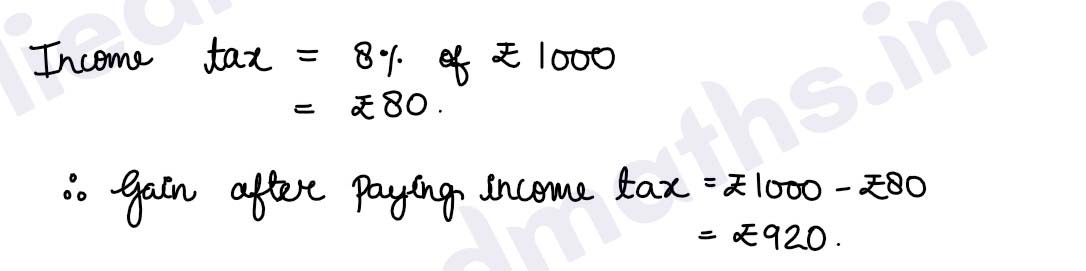

Q3. A man invested a certain amount in 3% stock at 90 [ brokerage 1/2] and sold it when the price rose to 102 [ brokerage 1(1/2)], to gain Rs 1000. How much did he invest? How much stock did he buy? What would have been his gain if he were to pay income tax at the rate of 8%?

Solution :

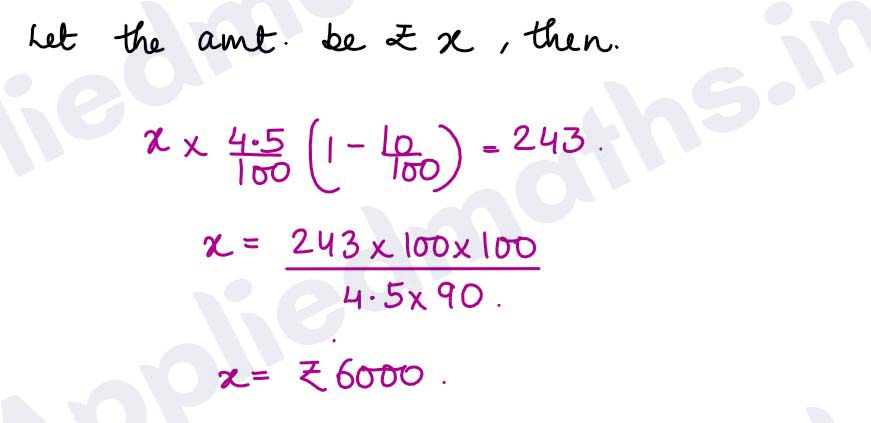

Q4. What amount of 4(1/2) % stock will produce an annual income of Rs 243 after paying income tax at the rate of 10 paise per rupee?

Solution :

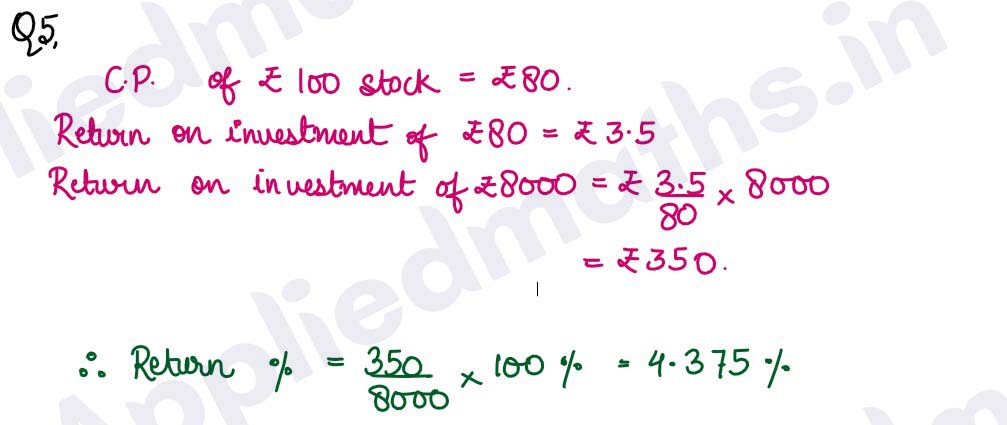

Q5. What will be my return percent if I invest Rs 8000 in 3(1/2) %, stock at a discount of 20?

Solution :

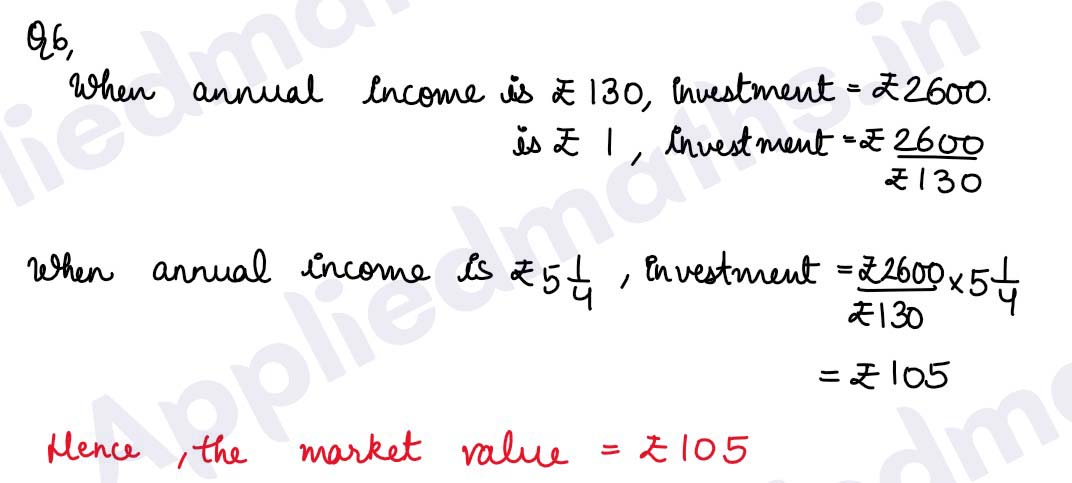

Q6. What is the market value of 5(1/4) % stock when an investment of Rs 2600 produces an annual income of Rs 130?

Solution :

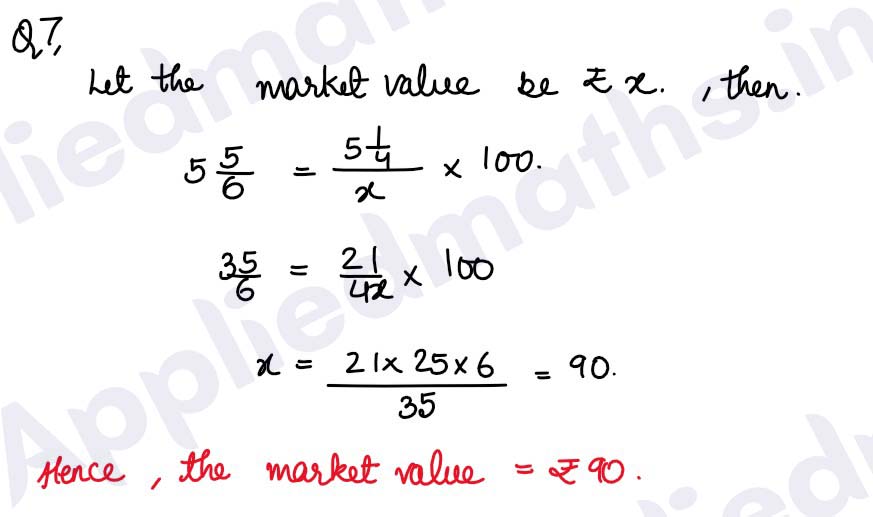

Q7. What is the market value of 5(1/4)% stock when an investment produces an annual return of 5(5/6)% ?

Solution :

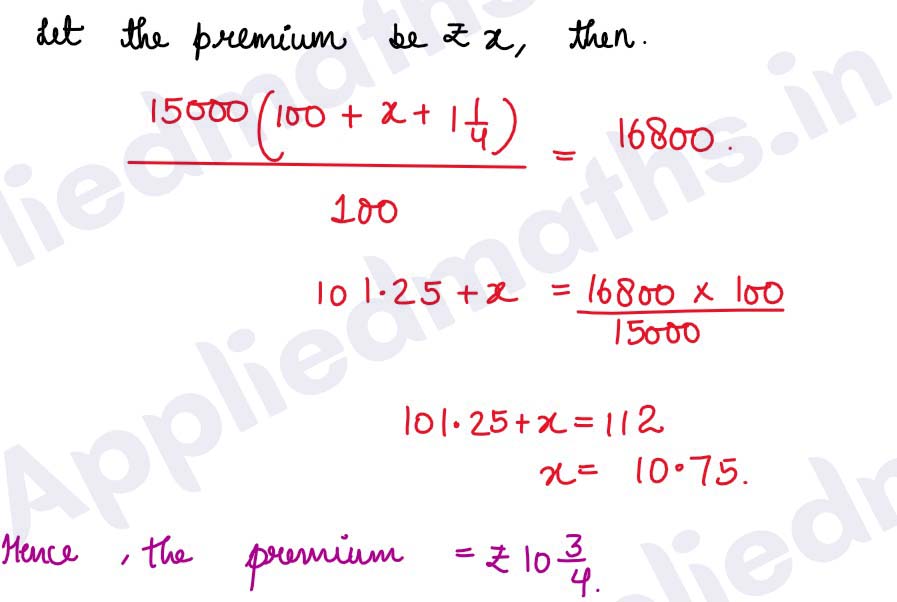

Q8. George purchased Rs 15000 stock at Rs 16800. If the brokerage is 1(1/4), find at what premium George bought the stock.

Solution :

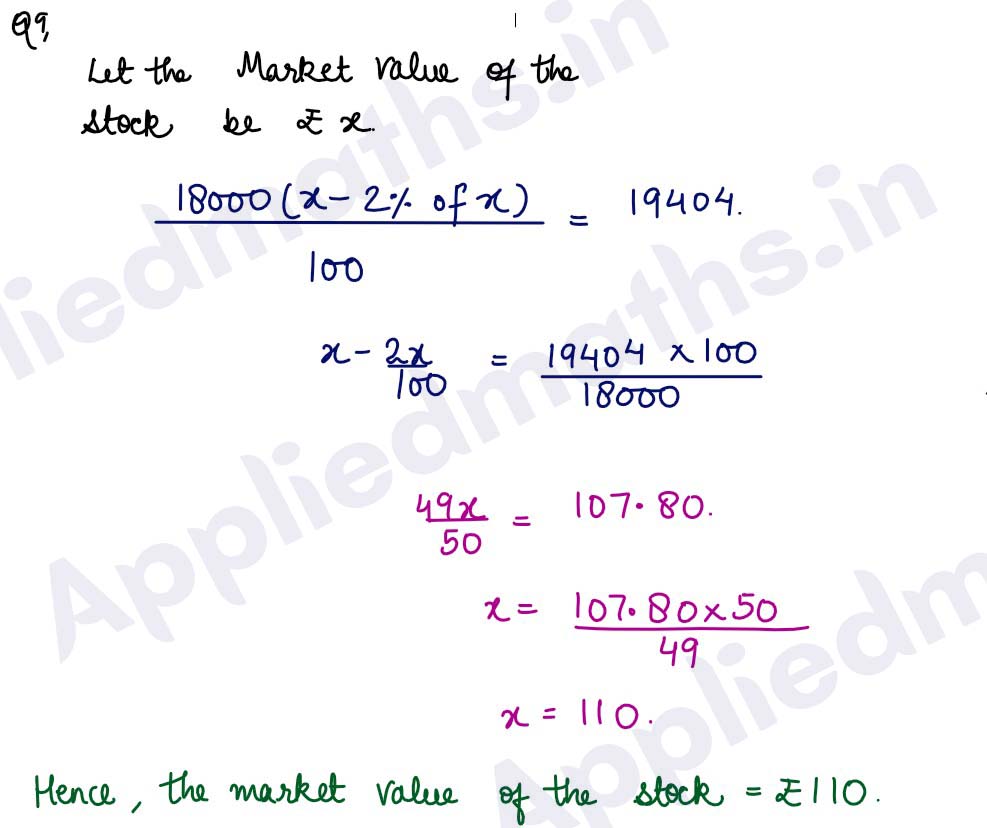

Q9. Ajay holds Rs 18000 stock. He sells it to realize a net amount of Rs 19404. If the brokerage is 2% of the transaction amount, find the market value of the stock.

Solution :

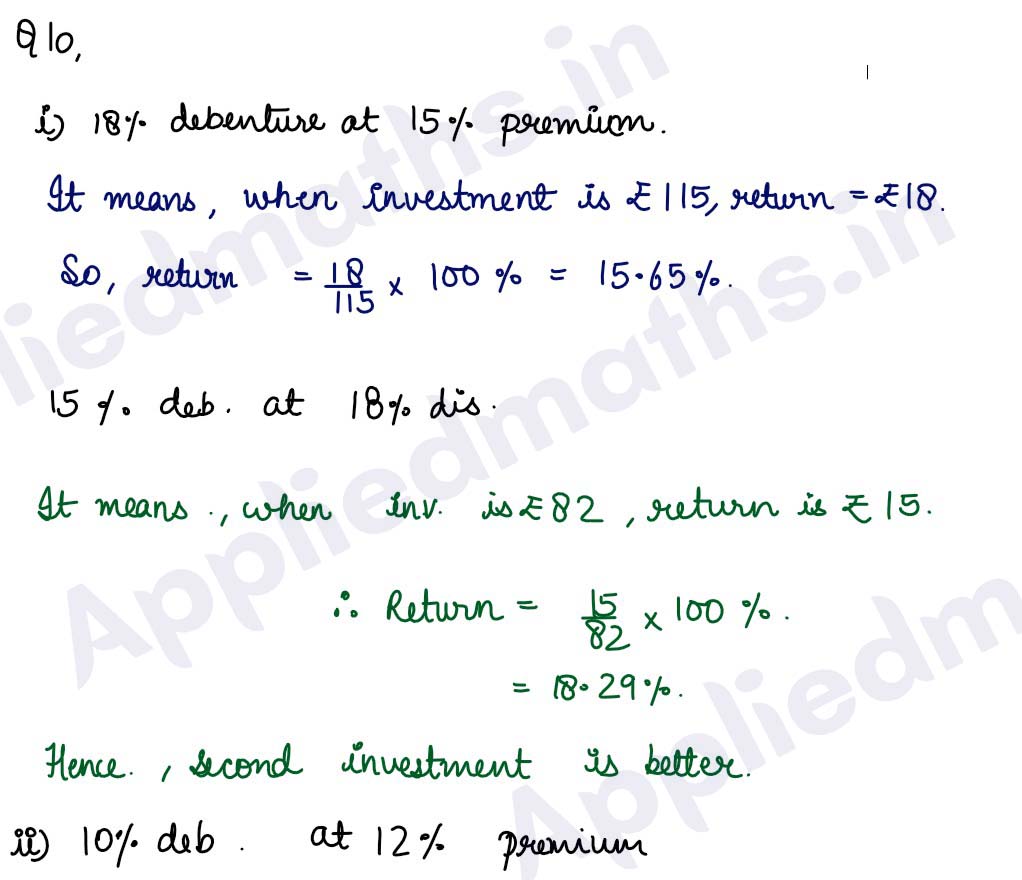

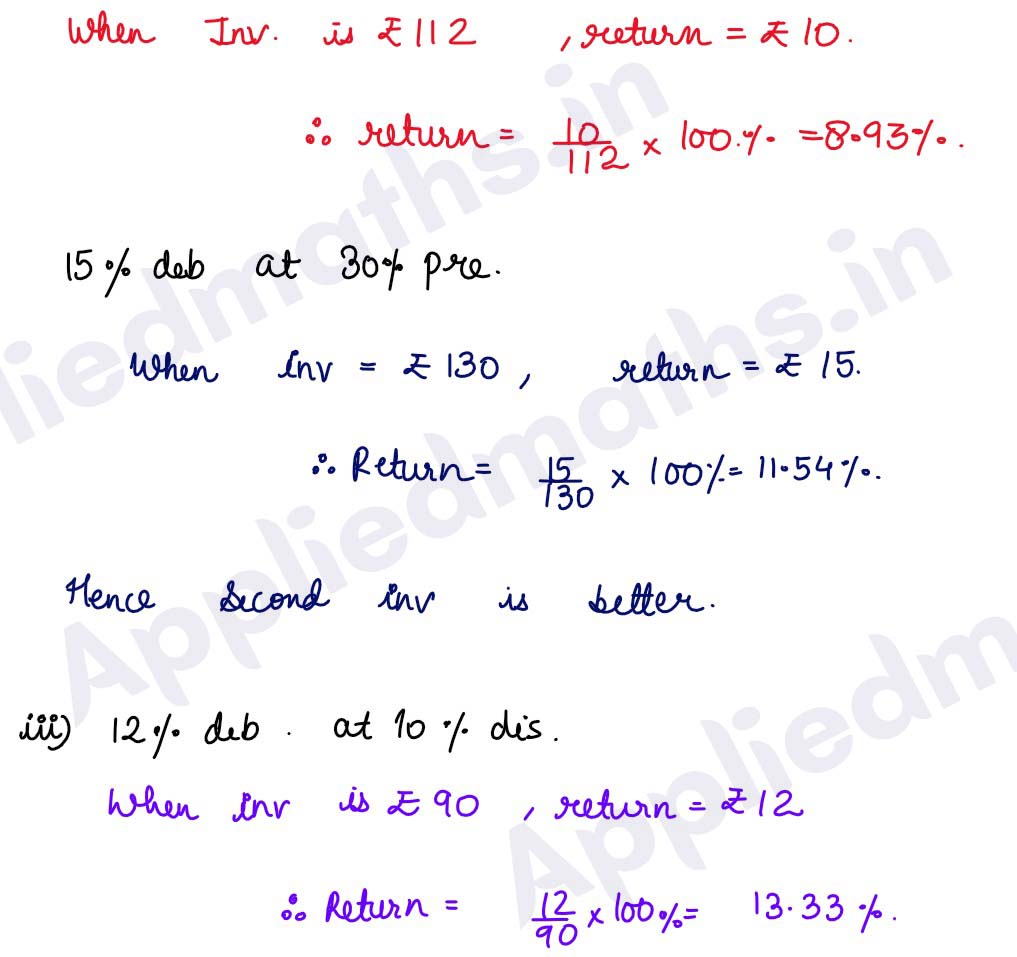

Q10.

Which is better investment:

(i) 18% debentures at 15% premium or 15% debentures at 18% discount?

(ii) 10% debentures at 12% premium or 15% debentures at 30% premium?

(iii) 12% debentures at 10% discount or 8% debentures at 20% discount?

Solution :

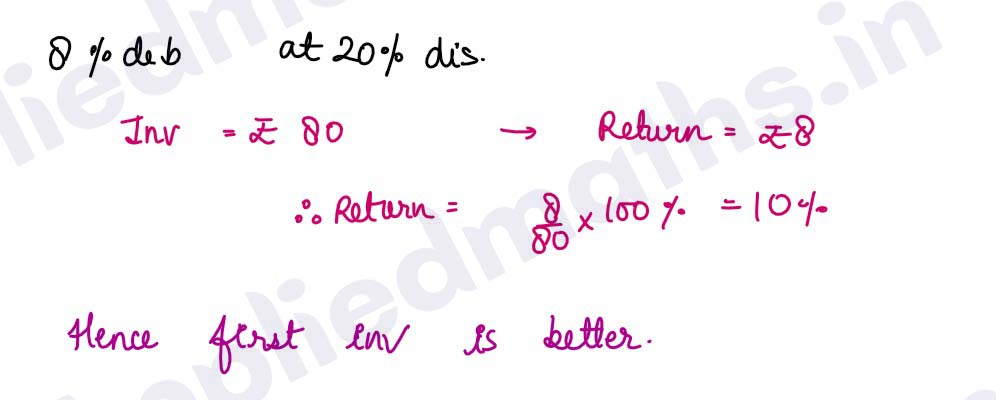

Q11.

(i) How many debentures of market value Rs 122 can be purchased for Rs 12300, brokerage

being 1% of face value?

(ii) How many debentures of market value Rs 122 can be purchased for Rs 12322, brokerage

being 1% of market value?

Solution :

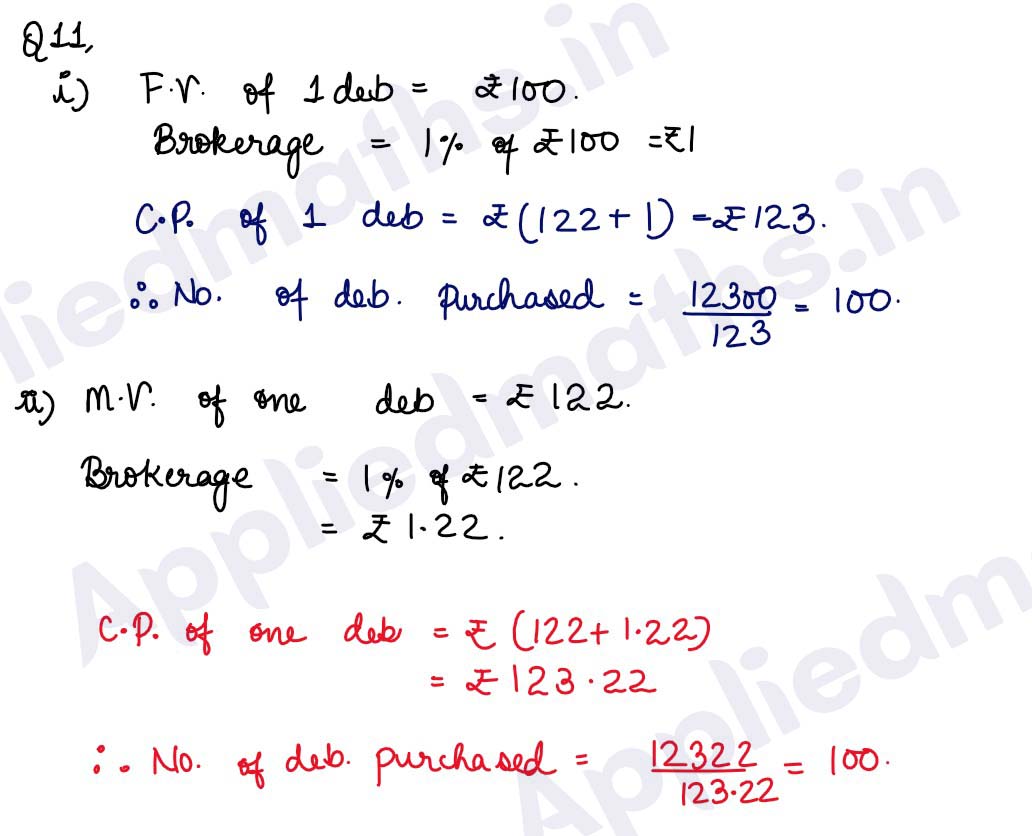

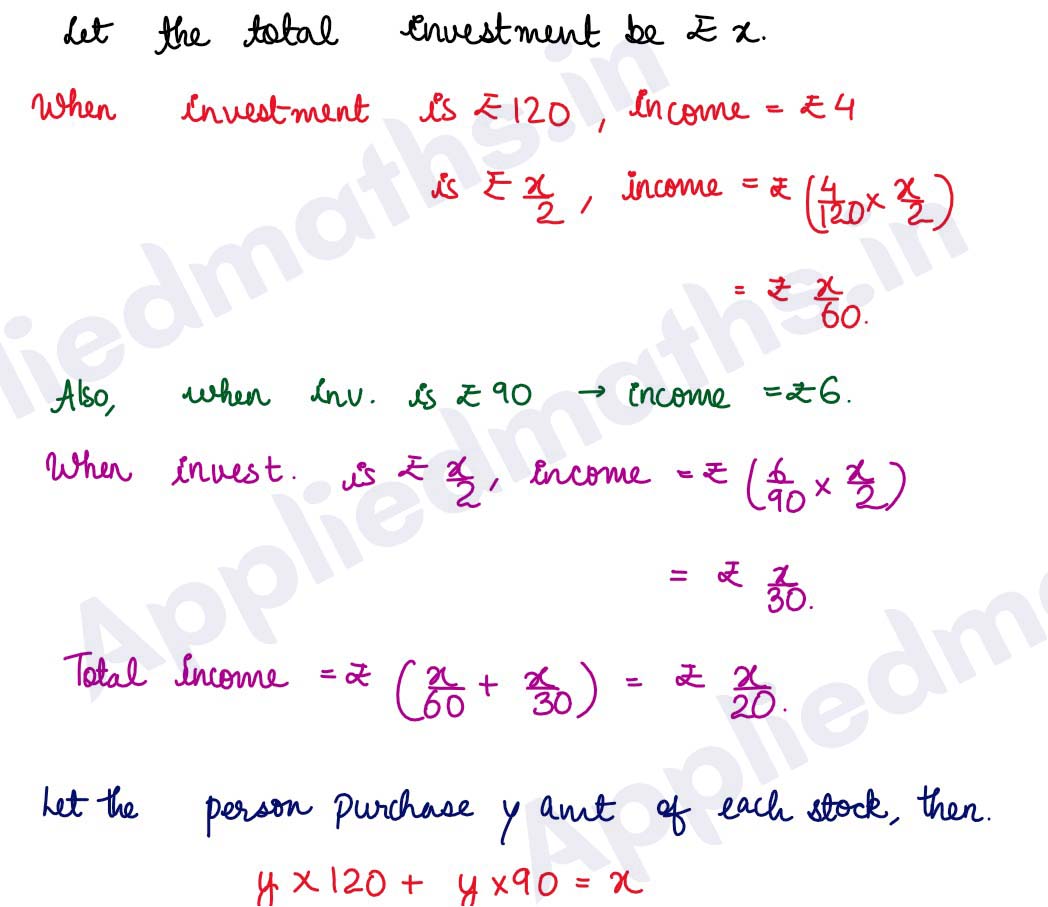

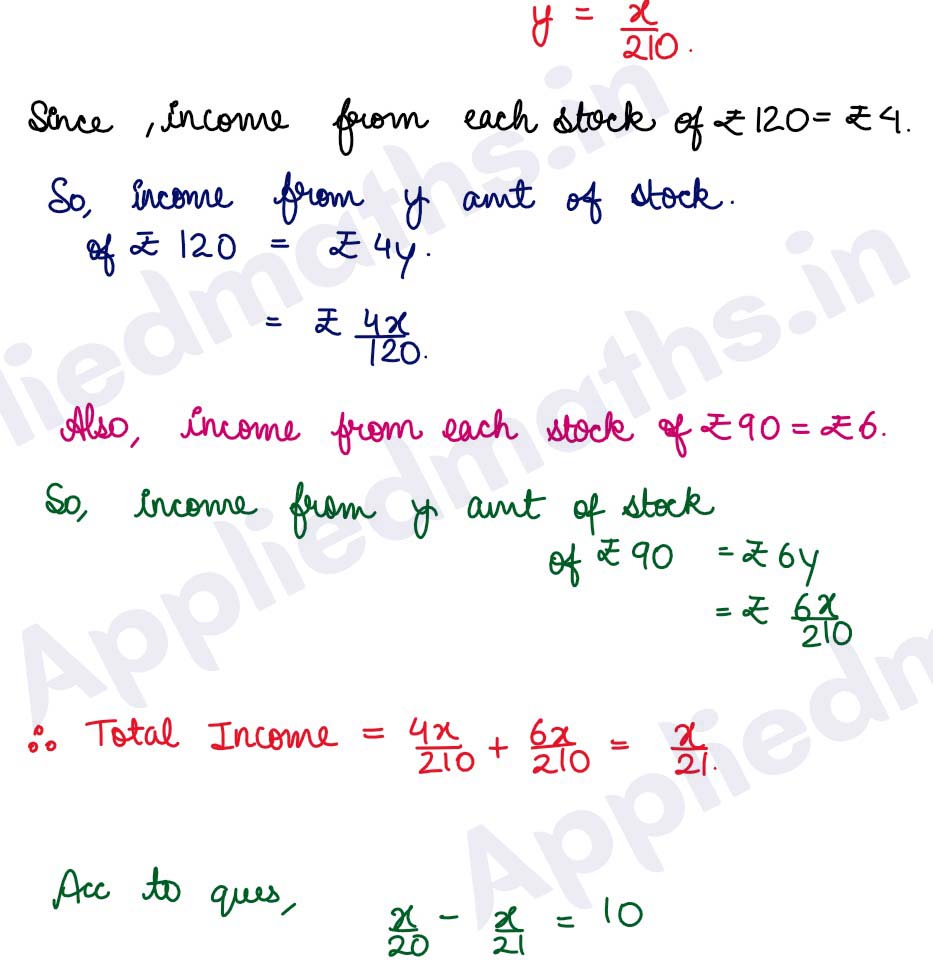

Q12. A person invests half of his money in 4% stock at 120 and the other half in 6% stock at 90. Had he invested his money in order to buy equal amounts of each stock, he would have got Rs 10 less of income. Find the total investment.

Solution :

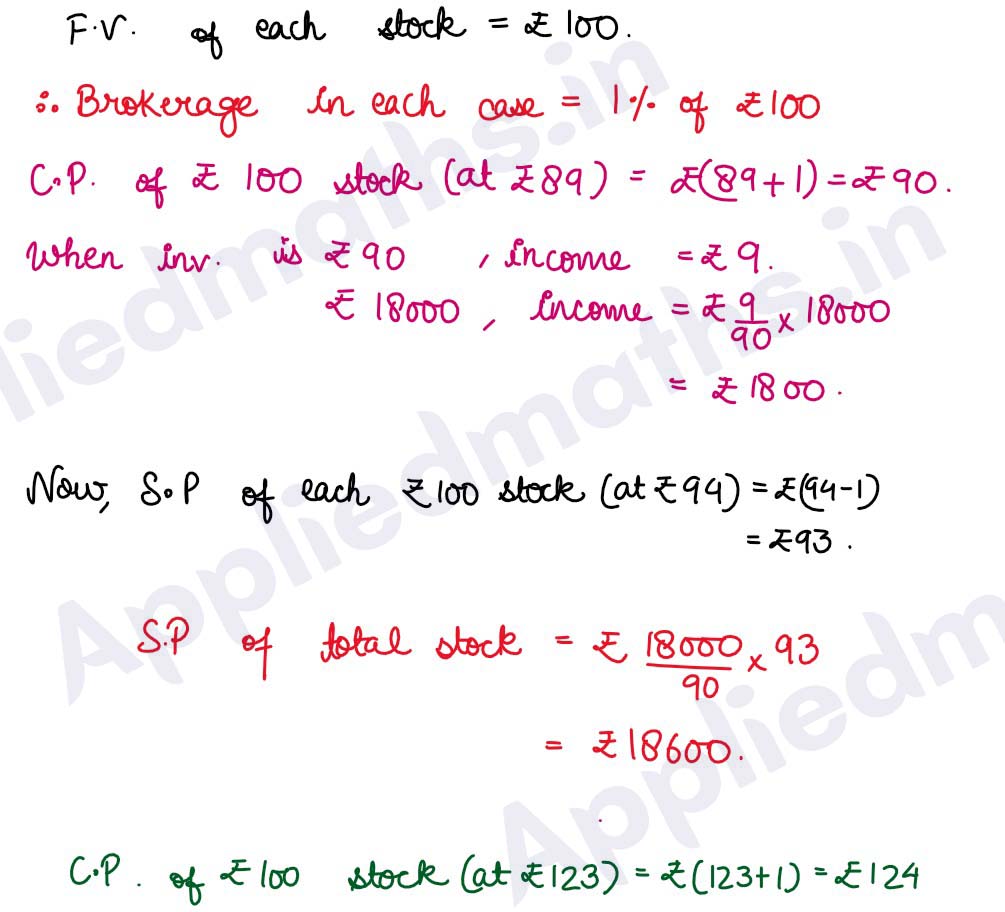

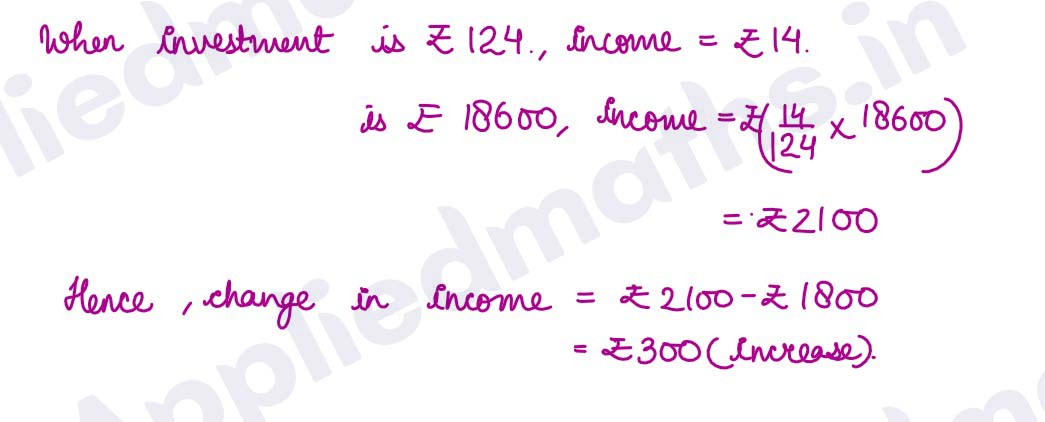

Q13. A person invested Rs 18000 in 9% stock at 89. He sells it when it has risen to 94 and reinvests all the proceeds in 14% stock at Rs 123. The rate of brokerage on each transaction is 1% of face value. Find the change in his income.

Solution :

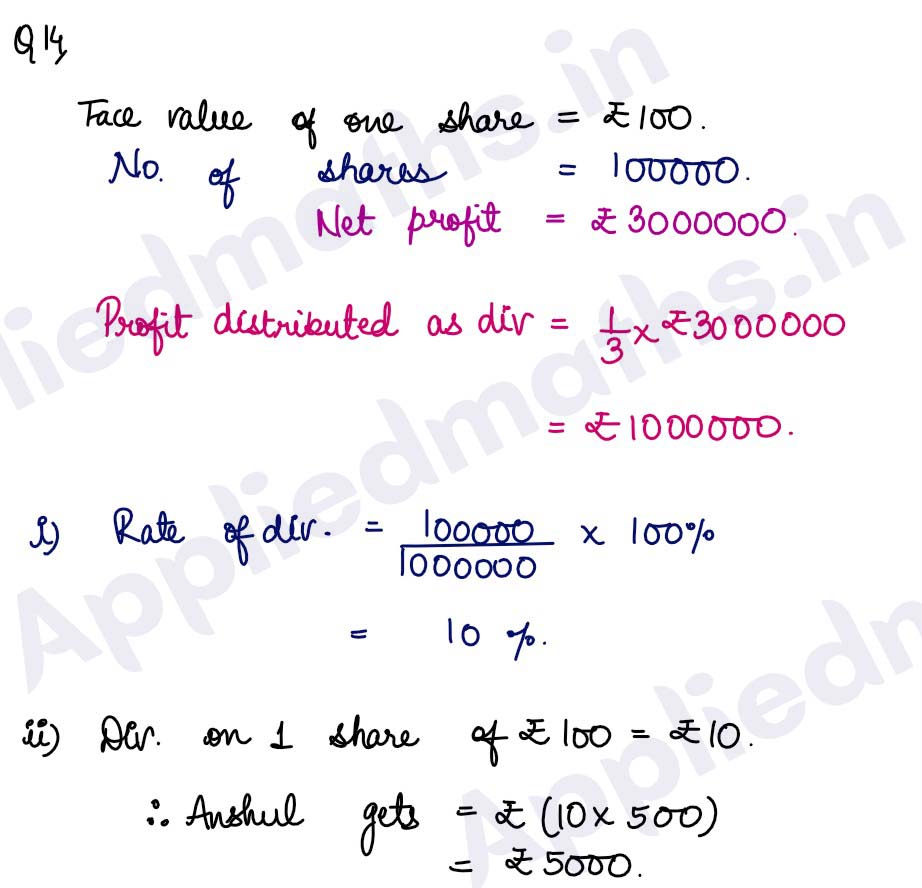

Q14.

A software company has 1 lac shares of par value Rs 100 each. It shows a net profit after tax of

Rs 30 lacs. The board of directors decides to keep two thirds of it for working expenses of next

year and expansion plans and distribute the remaining as dividend.

(i) What is the rate of dividend?

(ii) If Anshul owns 500 shares, how much dividend does he get?

Solution :

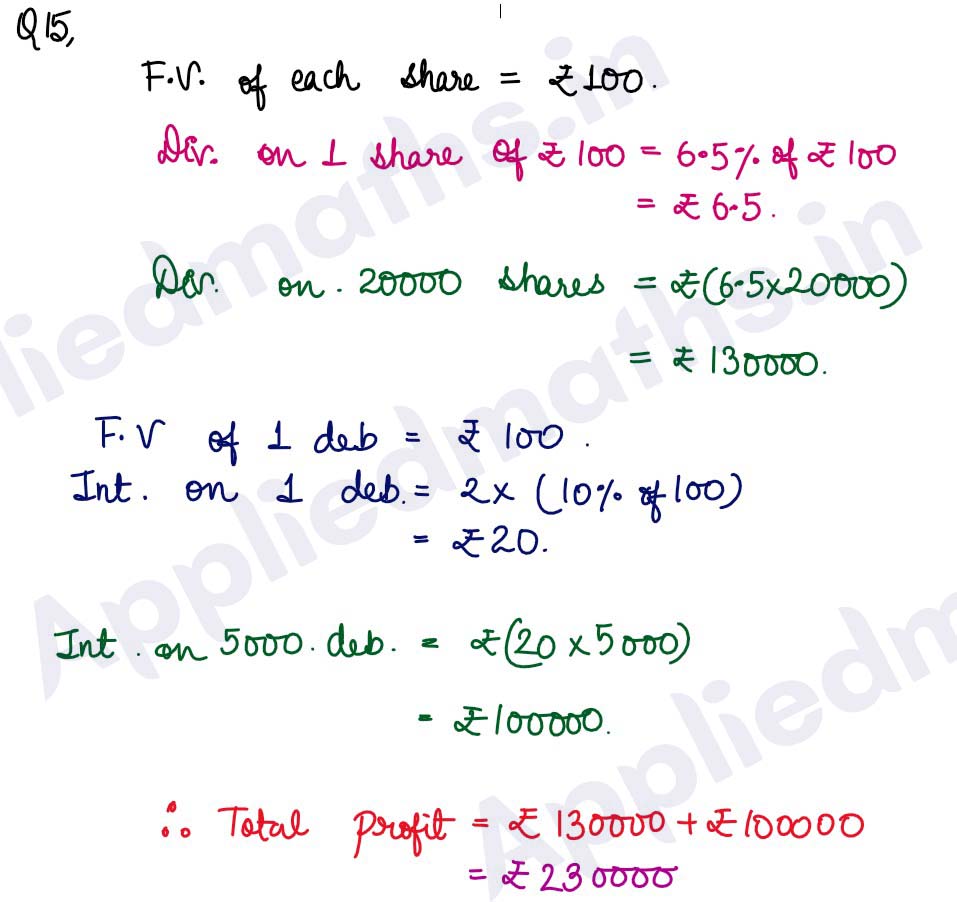

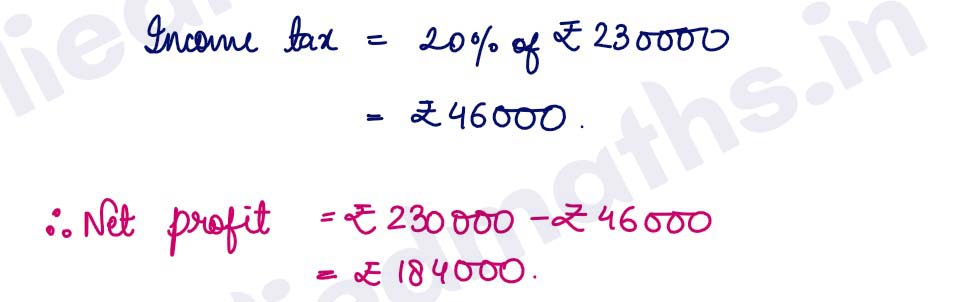

Q15. Harshad owns 20000 shares of face value Rs 100 each of a company paying dividend of 6(1/2) % per annum. He also has purchased 5000 debentures of par value Rs 100 each, on which the company pays semiannual interest of 10%. If the income tax is levied at the rate of 20 paise per rupee, calculate the annual net profits of Harshad from investment in the company.

Solution :

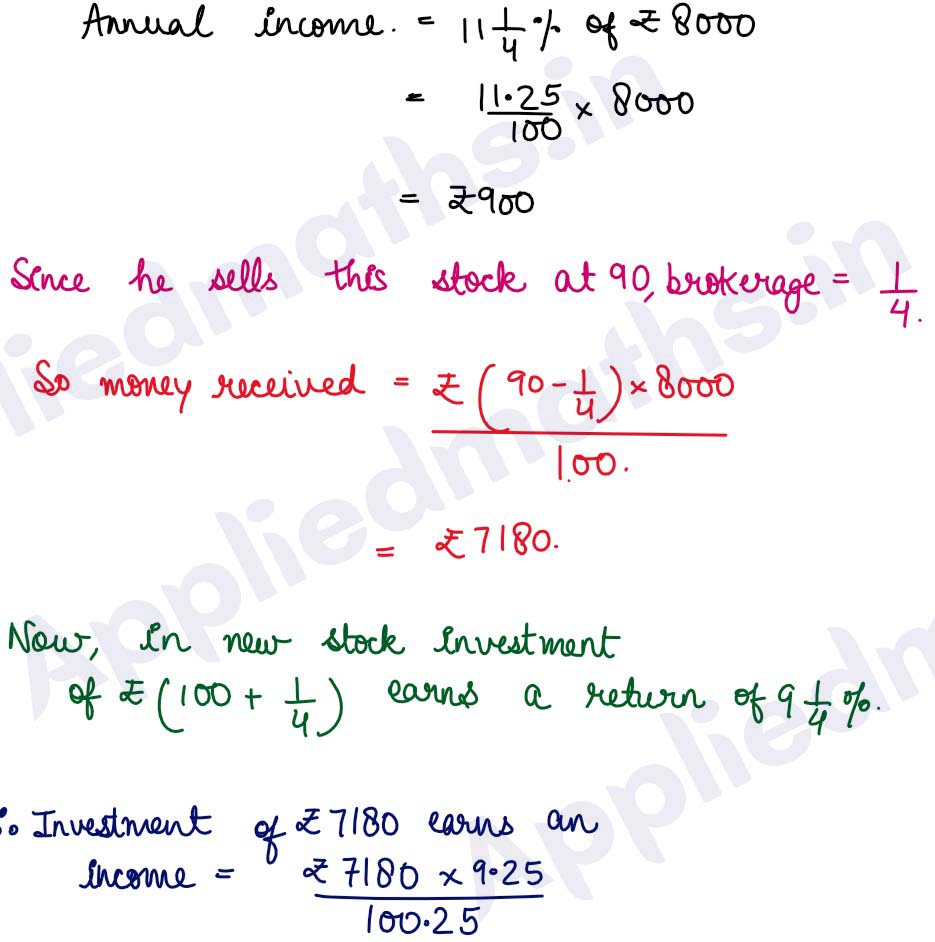

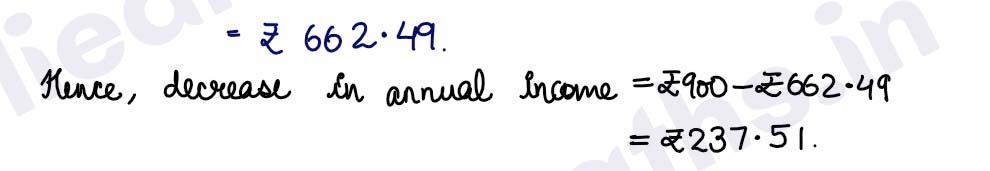

Q16. Find the change in income by transferring Rs 8000 of 11(1/4) % stock at 90 t oa 9(1/4) % stock at par. Brokerage is 1/4 in each case.

Solution :

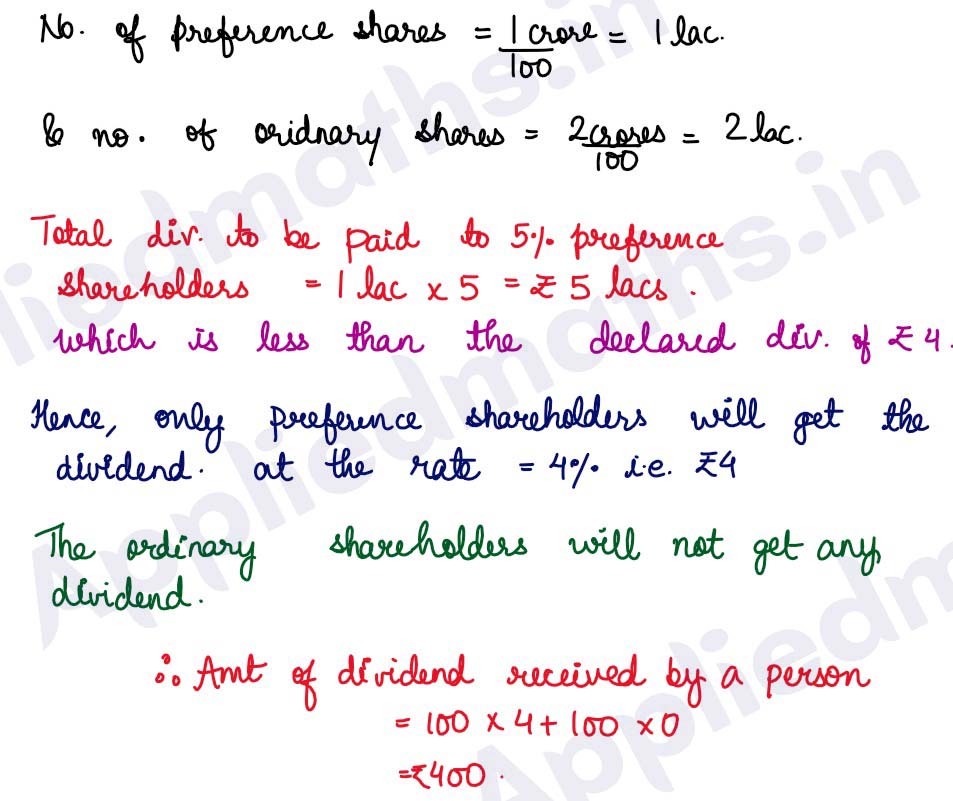

Q17. A company has total capital of Rs 3 crores —1 crore in 5% preference shares and 2 crores in ordinary shares, each of face value Rs 100. It declares a total dividend of Rs 4 lacs. Find the amount of dividend received by a person holding 100 preference shares and 100 ordinary shares.

Solution :

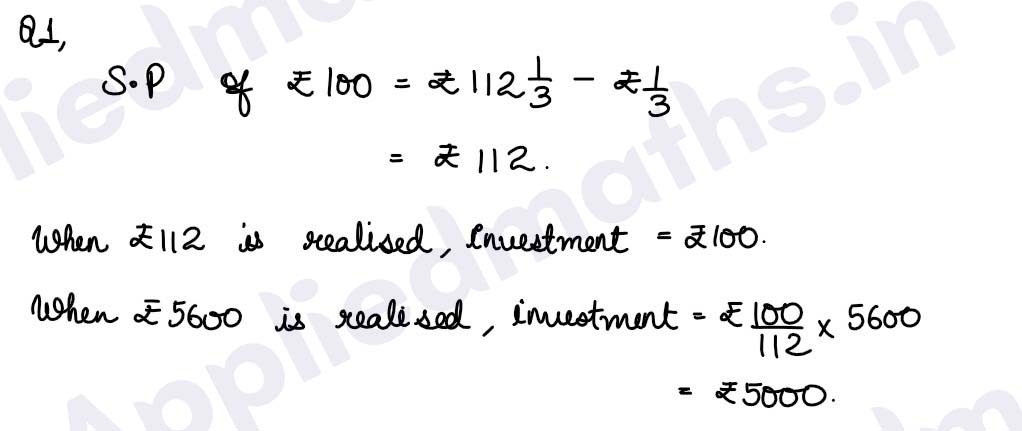

Q18. A person buys a certain amount of 6% preference shares quoted at Rs 113 cum-div. Just after receiving the dividend, he is forced to sell them. If brokerage in each transaction is 1/8. What is the minimum price at which he must sell so as not to be put into any loss? Also calculate the amount of dividend received by him if his initial investment was Rs 22625.

Solution :