Accounting For Partnership Firms - Fundamentals Chapter Important Questions

Accountancy is a subject that deals with the systematic study of recording and classifying and also maintaining reports on every transaction, business or otherwise. This record maintenance is very valuable as it gives important feedback to the management with regard to the financial situation of the institute

Please Select

Some Important Questions :

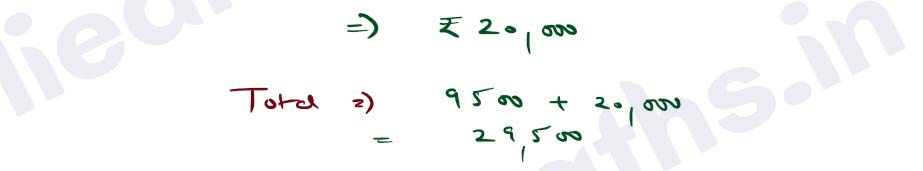

Q1. Girish and Satish are partners in a firm. Their Capitals on April 1, 2019 were Rs 5,60,000 and Rs 24,75,000 respectively. On August 1, 2019 they decided that their Capitals should be Rs 25,00,000 each. The necessary adjustment in the Capitals were made by introducing or withdrawing cash. Interest on Capital is allowed at 6% p.a. You are required to compute interest on Capital for the year ending March 31, 2020.

[Ans. Interest on Capitals : Girish Rs 31,200 and Satish Rs 29,500.]

Solution :

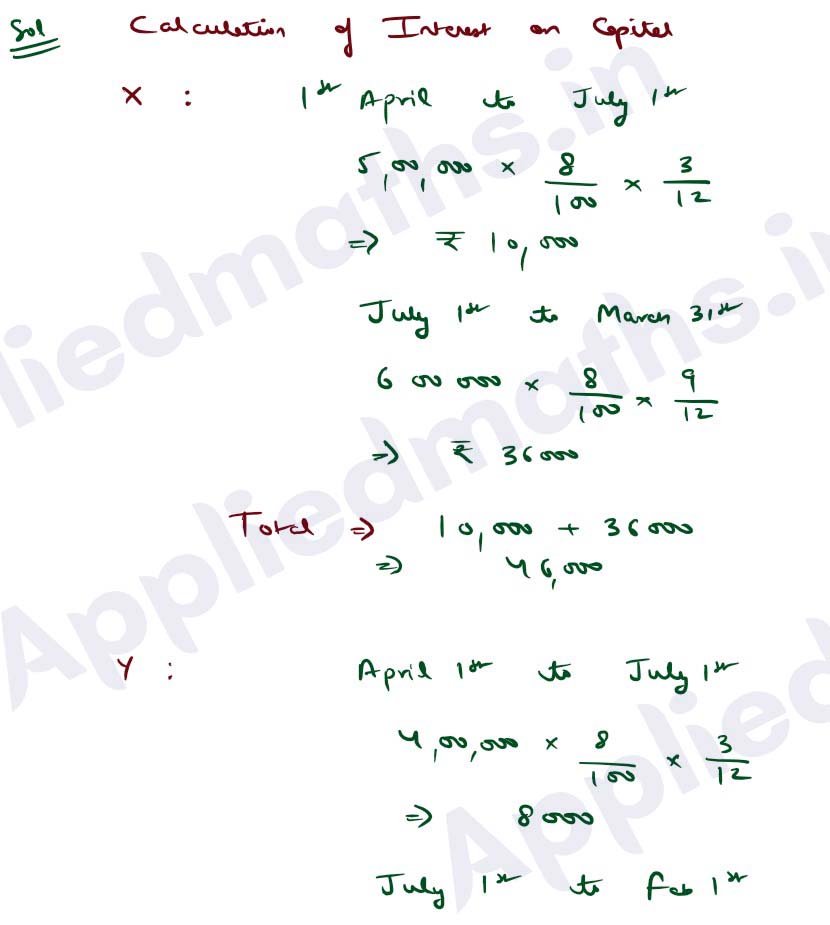

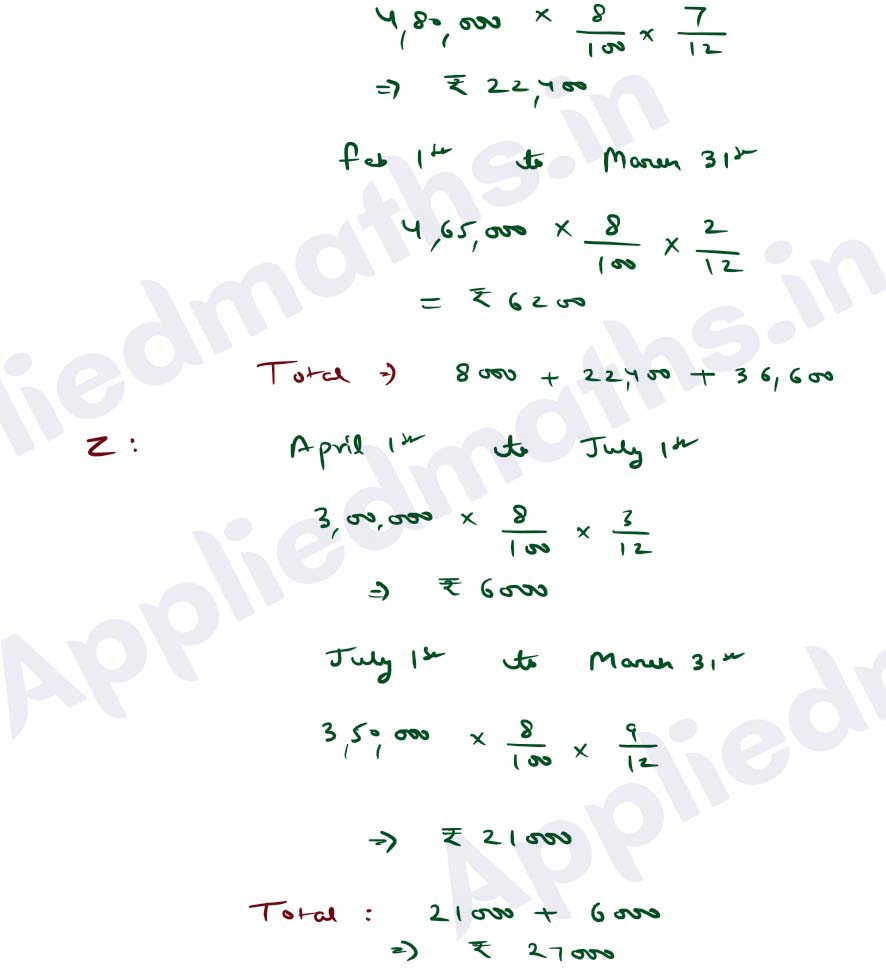

Q2. X Y and Z are partners in a firm. Their Capitals as on, April 1 , 2019 were Rs 5,00,000; Rs 4,00,000 and Rs 3,00,000 respectively. On July 1, 2019 they introduced further Capitals of Rs 1,00,000; Rs 80,000 and Rs 50,000 respectively. On February 1, 2020 Y withthrew Rs 15,000 from his Capital. Interest is to be allowed @ 8% p.a. on the Capitals. Compute interest on Capitals for the year ending March 31, 2020.

[Ans. Interest on Capitals : X Rs 46,000; Y Rs 36,600 and Z Rs 27,000.]

Solution :

Q3. 0n March 31, 2019 after the close of accounts, the capitals of Mountain, Hill and Rock stood in the books of the firm at Rs 4,00,000; Rs 3,00,000 and Rs 2,00,000 respectively. Subsequently, it was discovered that the interest oh capital @ 10% p.a. had been omitted. The profit for the year amounted to Rs 1,50,000 and the partner's drawings had been Mountain : Rs 20,000; Hill Rs 15,000 and Rock Rs 10,000. Calculate interest on capital.

[Ans. Interest on Capital : Mountain Rs 37,000; Hill Rs 26,500 and Rock Rs 16,000]

Solution :